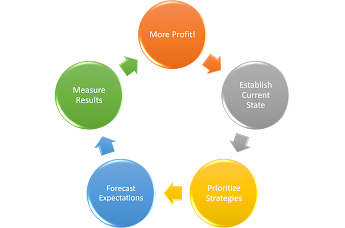

For clients, REPCFO's main focus is to provide value. For any service provider, every dollar invested in services should yield some form of return on investment (ROI). Yes, REPCFO services may show up as an expense on your P&L statement under "professional services," but in all of my engagements, the expectation is the Net Profit growth of your organization will far exceed your investment in the services provided.

When engaging with a Virtual CFO, you should expect:

Financial Planning & Analysis

Any engagement begins with a baseline analysis of the current state of operations. As a rule, REPCFO provides an analysis of the current state of operations and works with the ownership team of the organization to identify key areas where improvement will yield measurable improvement in overall organization improvement.

Short Term Strategic Planning

Most early stage organizations that do not have the resources to hire a full time CFO could benefit from a voice that can help the organization with understanding the key performance and strategic priorities that will yield improvement in customer satisfaction, market growth opportunities, operational productivity, and pricing strategies. REPCFO works with clients to help them visualize the potential results of various strategy enhancements and establish measurable expectations of success through financial forecasting.

Loan Packaging Assistance and Financial Due Diligence

With years of experience of raising both equity and debt capital, REPCFO can produce loan packages or financial due diligence so investors that the information necessary to make quicker approval decisions. REPCFO is aware of many points of capital access in the Pacific Northwest and can provide guidance regarding financing opportunities. REPCFO does not serve as a financial broker for any financing group and does not accept commissions on financing deals, so all advice is geared towards what is best for our clients.

Accounting System Cleanup - Set-Up

REPCFO can quickly recognize if financial statements are not serving their intended purpose to guide the measurement of business performance in real time. Our team can help you set up or clean up you procedures for tracking financial performance so you have weekly dashboards to clearly measure business performance. Since each business is unique, our engagements begin with truly understanding your business model and providing a level of customization that few other financial services consultants offer.

HR and Staff Training

REPCFO recognizes that many business owners are new to managing teams. With expertise providing HR and Staff training to organization of over 100 employees, our team can support your development of your team, establish employee training materials, as well as basic advice on compliance with Federal/State labor laws.